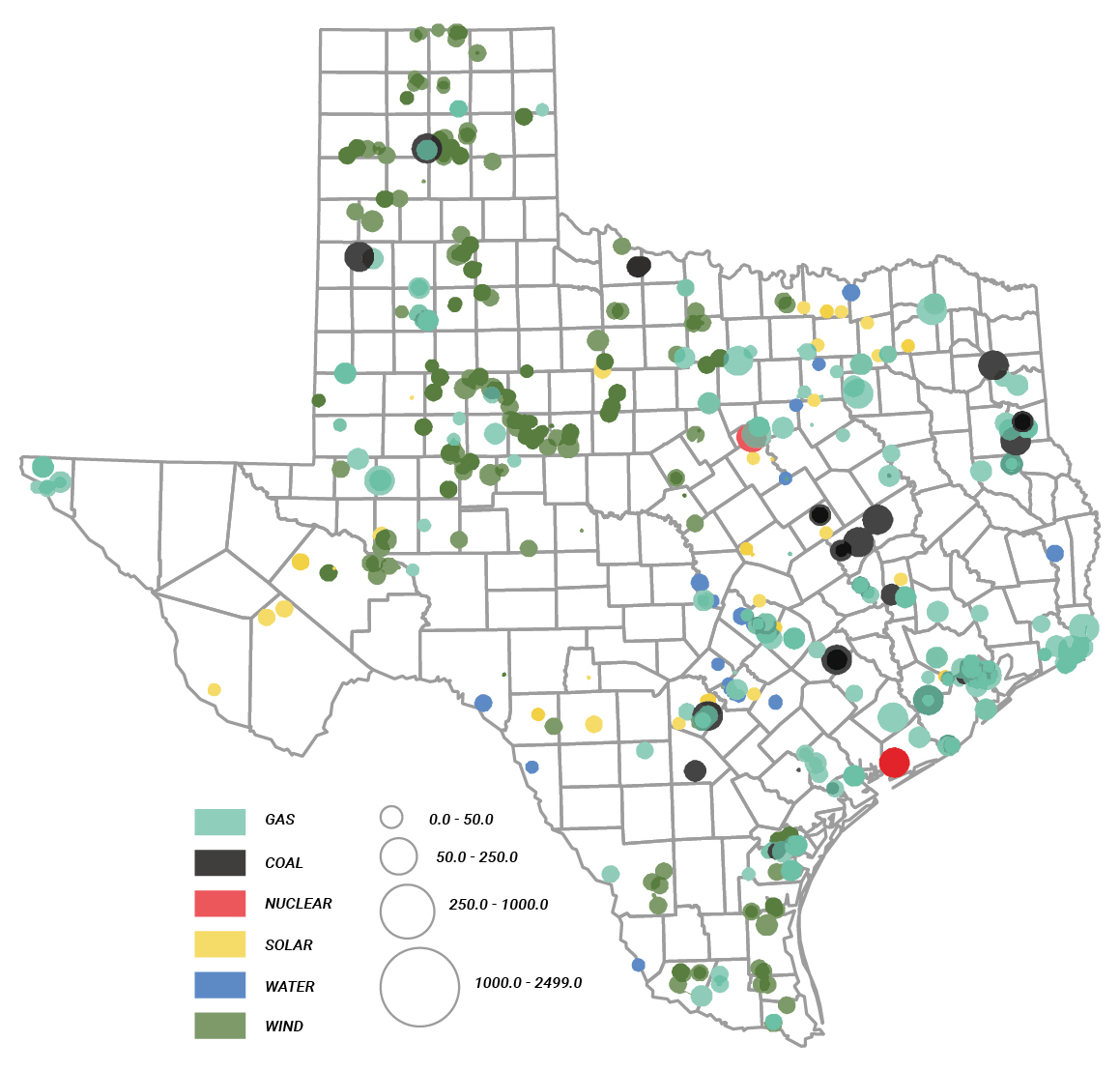

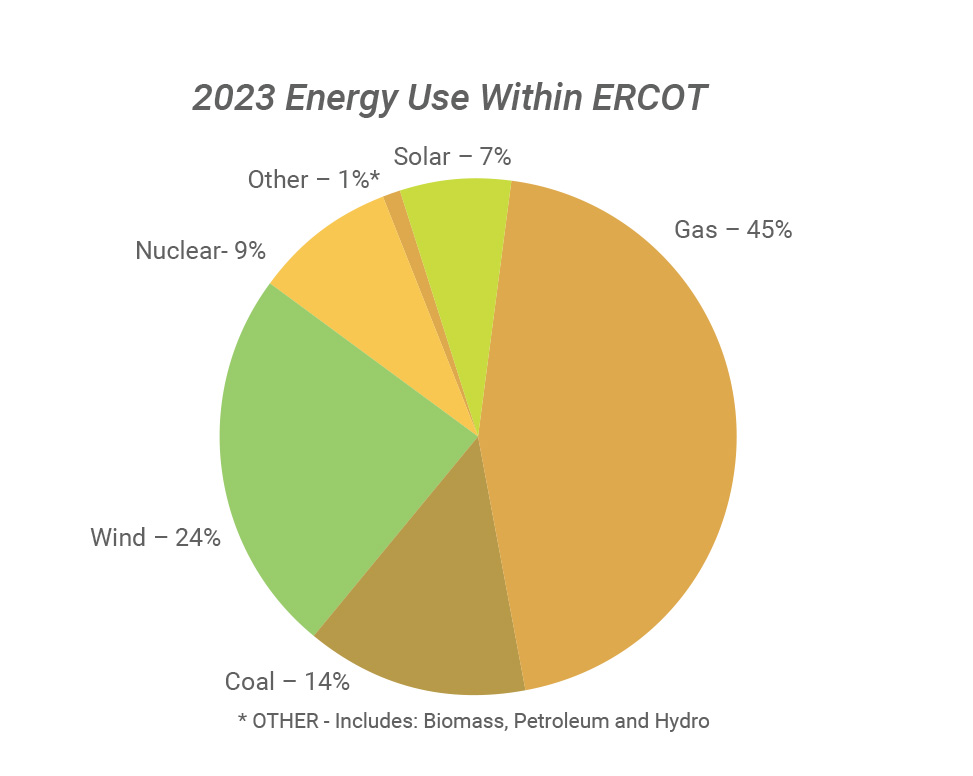

There are five major energy resources that produce our electricity in Texas: natural gas, coal, wind, nuclear and solar. These resources are sometimes referred to as renewable resources (solar and wind) and non-renewable resources (coal, natural gas and nuclear). While for many years, gas, coal and nuclear were the top three providers of electricity in Texas, today, gas is followed by wind and then coal, but solar is expected to become the third most important resource within a year surpassing coal.

Overall Electric Demand

Texas uses more electricity than any other state. Texas’s growing population and accompanying economic growth are driving increased electric demand. Between 2018 and 2022, the state’ s population grew by 5%, statewide electricity use grew by 11% and in the main electric grid known as ERCOT, peak load grew by 9%. And records keep falling. In the hot summer of 2023, ERCOT set a series of new records, including a new peak demand record of 85,435 MWs on August 10th, 2023. This peak demand was roughly 5,000 MWs higher - or about 7% more than the record just a year before. Similarly, a cold January also set a new winter peak demand record in 2023. Climate change and climate extremes are driving electricity use up throughout Texas, causing concerns that the widespread brownouts in 2021 during Winter Storm Uri could repeat themselves.

ERCOT’s August 2023 Peak Records

Previous Peak: 78,465 MW set 08/02/2022

| Month | Demand (MW) |

| August 1 | 83,593* |

| August 7 | 83,854* |

| August 9 | 83,961* |

| August 10 | 85,435* |

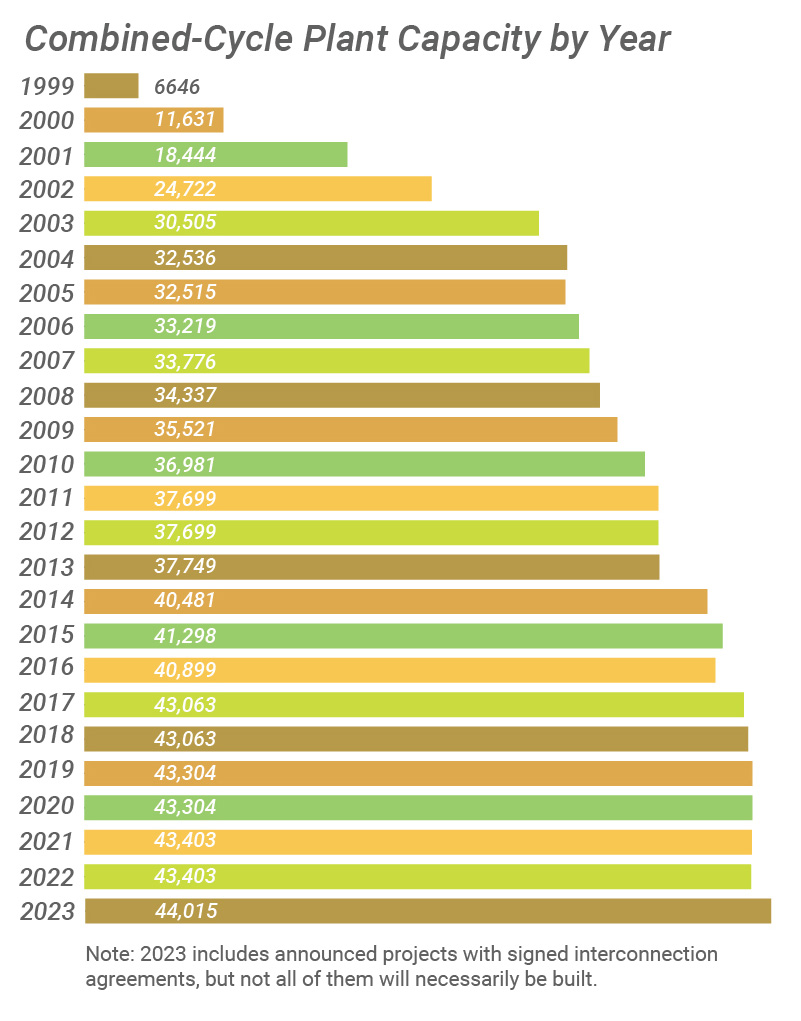

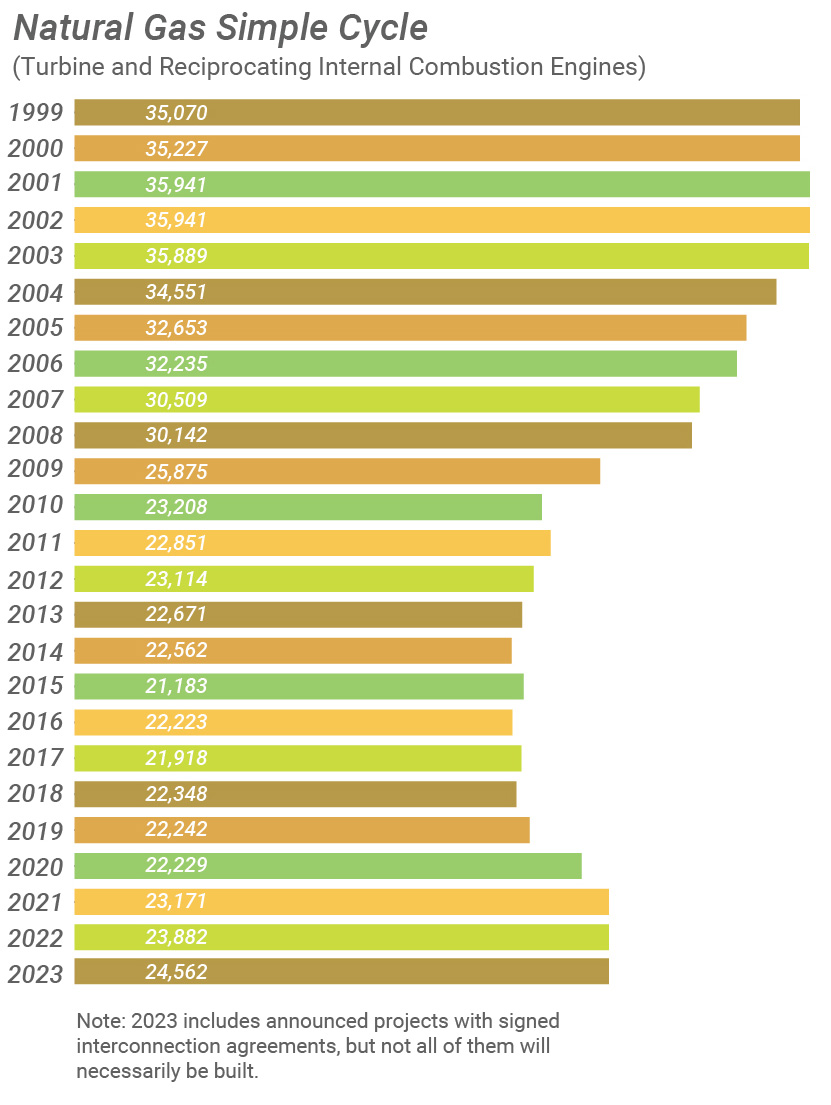

Gas. Texas is the leading producer of gas in the United States, and a large portion of this is used in large and not so-large power plants to produce electricity. In fact, in 2022, about 43% of our electricity came from gas within ERCOT, and gas is also a major portion of the energy mix in the other grids that serve Texas. Indeed, in late 2021, Entergy announced their intent to build a gigantic new gas plant in Orange County despite some community opposition, and the entity received approval in 2022. Gas can be used in "peaker" plants that are only used when electricity demand is high, as well as larger steam engine and combined cycle plants, which combine steam engines with turbines, and generally operate more frequently than peaker plants. Thus, in 2022, peaker plants provided about 7 percent of the energy used in ERCOT, while combined cycle plants provided about 35% of all electricity. While gas has been an important resource to keep the lights on in Texas, it can have serious health and environmental impacts during its extraction, transport, and combustion for the production of electricity.

Overall, a number of older "simple-cycle" gas resources have been retiring, although there have been a smattering of newer combined-cycle gas plants coming on-line. More recently, a number of entities have invested in newer "reciprocating engine" technologies which are generally smaller but are quicker to come off and on-line, suited to meeting our peaks in demand.

Coal. For decades, coal has been an important resource for the production of electricity in Texas. Indeed, some 10 years ago, there was serious consideration being given to proposals to increase the amount of electricity from coal plants when major power companies considered adding new coal plants to Texas's energy mix. A few of those plants did get constructed. In recent years, however, its proportion of our energy production has fallen significantly. In Texas, coal comes largely from two sources: in local coal seams mainly in northeast Texas (sometimes called Texas lignite), and Powder River Basin coal imported mainly from Wyoming. Coal plants are large sources of air pollution, including the gasses that cause climate change, and produce thousands of tons of coal ash (which can contain toxic lead, mercury, and other heavy metals). Texas coal plants emit more tons of sulfur dioxide, nitrogen oxide, and carbon dioxide than any other industry in Texas, while mercury from coal plants can get into the water, soil, and eventually aquatic species like fish. At one time there were 19 coal plants in Texas, but today there are only 12 operating. In 2018, three coal plants in northeast Texas, and one in San Antonio retired, while in 2019, the Gibbons Creek coal plant was shuttered and mothballed indefinitely. In 2021, this plant was officially physically destroyed. In 2020, the Oklaunion coal plant in North Texas was closed. Finally, SWEPCO closed its Pirkey plant in 2023 after 38 years of operation. Overall, coal produced about 17 percent of all electricity within ERCOT in 2022, but within a few years that number will continue to shrink.

There are currently no additional investments being made in new coal plants today, and most energy experts continue to predict more retirements both inside and outside of ERCOT as economic realities, new environmental regulations imposed by the EPA and demand by Texas residents for a cleaner environment put pressure on companies and power generators that own coal resources. In fact, in 2020, SWEPCO in Northeast Texas announced plans to close down its two coal plants -- Pirkey and Welsh - in 2023 and 2028 respectively. In addition, SPS, owned by Xcel Energy, announced its intention to switch its coal plant at the Harrington Generation Station near Amarillo from coal to gas before 2025 under an enforcement order by the Texas Commission on Environmental Quality due to high sulfur levels, and also announced they would retire their other coal plant - Tolk - most likely by 2028. Moreover, in late 2020, Vistra Energy announced they were planning to close one of their coal plants -- Coleto Creek near Goliad and Victoria -- by 2027 due to the need to comply with coal ash requirements that would be very expensive. In addition, in late 2022, CPS Energy announced plans to shut down Spruce 1 and convert Spruce 2 to run on gas. Finally, Austin Energy has been negotiating the potential closure of one of three units it jointly operates with the Lower Rio Colorado River Authority, but those negotiations have stalled as the two entities discuss potential retirement dates for at least one of the units.Thus, by 2028, at least four additional coal units should either be retired or converted to gas in Texas.

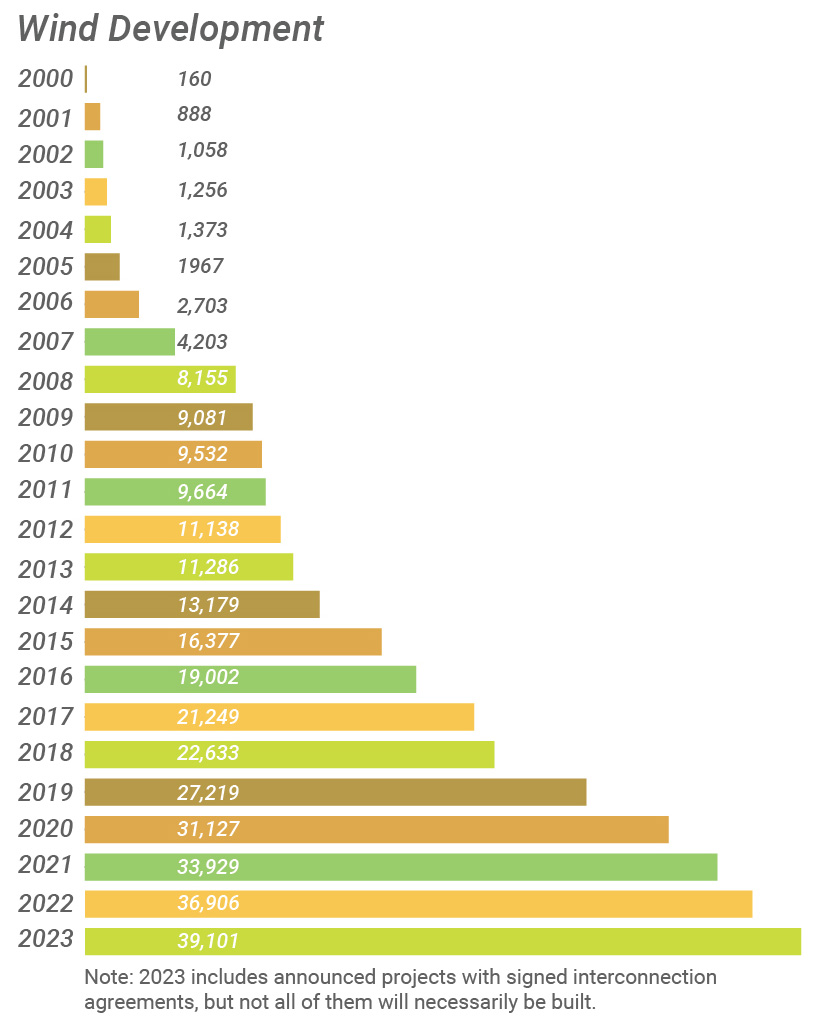

Wind. Texas has more wind power installed than any other state and produces more wind power then any other state. In general, wind in West Texas blows hardest at night, and in the fall and spring, while wind in South Texas and along the coast is steadier during the day. When Texas passed the electricity deregulation bill back in 1999, it added a requirement that a small amount of future power come from renewable resources like wind and solar. In 2005, the Texas Legislature expanded that goal to at least 5,880 megawatts (MWs) by 2015, and 10,000 MWs by 2025. However, wind development has been so successful in Texas that we achieved that goal years ahead of schedule, and by 2020, we had more than 25,000 MWs of wind installed in ERCOT, with significant amounts also installed in the Southwest Power Pool, meaning about 30,000 MWs of wind were producing electricity in Texas. By the end of 2023, nearly 39,000 MWs in ERCOT alone are expected to be operational.

On April 10th, 2022, wind set a new penetration record, providing 69.15% of all electric demand, while on May 29th, 2022, ERCOT reached an all-time high for hourly wind generation of 27,044 MWs.

The future for wind development appears steady, although issues of sufficient transmission and congestion in many areas of the state have constrained some generation, an issue that will still have to be resolved. ERCOT shows in its monthly generation reports that thousands of additional MWs are expected to come online in coming years. In 2020, wind overtook coal as the second leading resource of electricity in Texas, providing about 22 percent of all energy, a figure that grew to almost 25 percent in 2022. By the end of 2023, wind output could well produce more than twice the energy from coal in Texas, if the approximately 39,101 MWs of wind that is already built or being considered for construction gets built.

Nuclear. Like many states in the 1970s and 1980s, Texas built huge nuclear power plants. There are two in the state: the South Texas Project (STP) in Matagorda County (jointly owned by NRG, CPS Energy, and Austin Energy) and Comanche Peak near Glen Rose southwest of Fort Worth. This plant is currently owned by Vistra Energy. Together these two power plants provide roughly 10% of the electricity used within the ERCOT grid in Texas and are the largest power plants in Texas. While nuclear power is an important component of our electricity system, they are not without controversy. First, there were massive cost-overruns with both plants, and as part of the deregulation bills and legal agreements, ratepayers absorbed these cost overruns to pay off "stranded" costs. Second, both plants require large volumes of water, which in times of drought can be challenging. Third, there continue to be concerns about accidental releases of radioactive and toxic components in nearby communities, and there is the larger concern about how to safely dispose of the high-level radioactive waste, which is presently stored on site but has no authorized final disposal site. While several new nuclear facilities have been proposed through the years, none are currently being considered due in large part to the huge upfront costs. There have been, however, two proposals to bring high-level waste to proposed storage facilities in West Texas and Eastern New Mexico. The Sierra Club has grave concerns about these proposals since thousands of tons of radioactive waste would be shipped across highways and railways. Currently, there are lawsuits opposing these two proposed high-level nuclear waste storage facilities and it will be many years before this issue is resolved.

Recently, there have been some developments in new technologies for smaller nuclear power plants and Dow, the chemical company, announced plans to build a small nuclear reactor for one of its facilities in Texas. Similarly, academic research in Texas is attempting to prove a different kind of nuclear technology known as “molten salt reactor” has commercial viability with a test reactor being built at Abilene Christian University. The research unit will take several years to be tested for commercial viability. The promoters of this technology state that it will produce less waste, be safer, be more scalable, and use less water than traditional nuclear fusion technology.

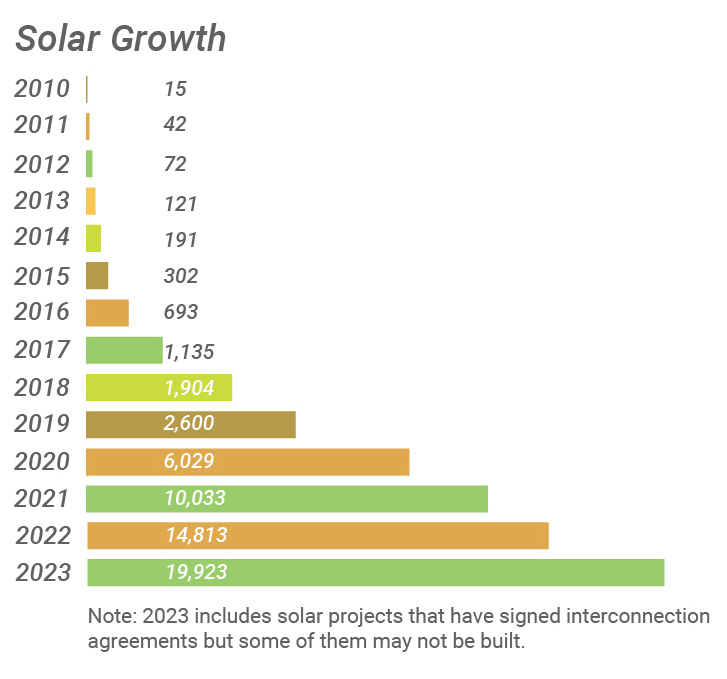

Solar. Solar is the new kid on the block. While Texas was once a laggard in solar production, by the middle of 2023, it was the second largest state in terms of installed solar capacity and could exceed California soon as the leader. While solar provided about 6 percent of electricity in Texas’s main grid in 2022, solar is likely to top 10 percent this year and could reach about 20 percent by the end of 2024. Costs have fallen dramatically in recent years, and solar panels are scalable, able to be put on residential or commercial building roofs, or located in rural areas on a "utility scale". Another option is "community solar", which are bigger than solar rooftop applications, but can be located closer to where more people live and empower community ownership through more direct investment. While there were no large-scale solar power plants in Texas until about five years ago, today roughly 18,000 MWs of solar are helping power Texas today, and that total will likely nearly double by the end of 2024. Recently, solar set a new record in ERCOT on August 2nd, 2023, on a very hot summer day, some 13,400 MWs of solar was energizing the grid. Another record that happened was on April 20th, 2023, when solar utility-scale plants produced a third - 32.93% - of all the electrical demand during one period. Through recent technological advancements, energy storage could further extend the value of solar technology. Even without storage, solar is becoming a much more important resource in Texas.

In addition to this utility-scale solar, Texas has almost 2,500 MWs of individual solar power plants operating on roofs, in parking lots, and in fields that are under 1 MWs in size and does not have to register as a "power generation" source. With so much roof space, Texas could literally power much of the state with rooftop solar.

Other Technologies

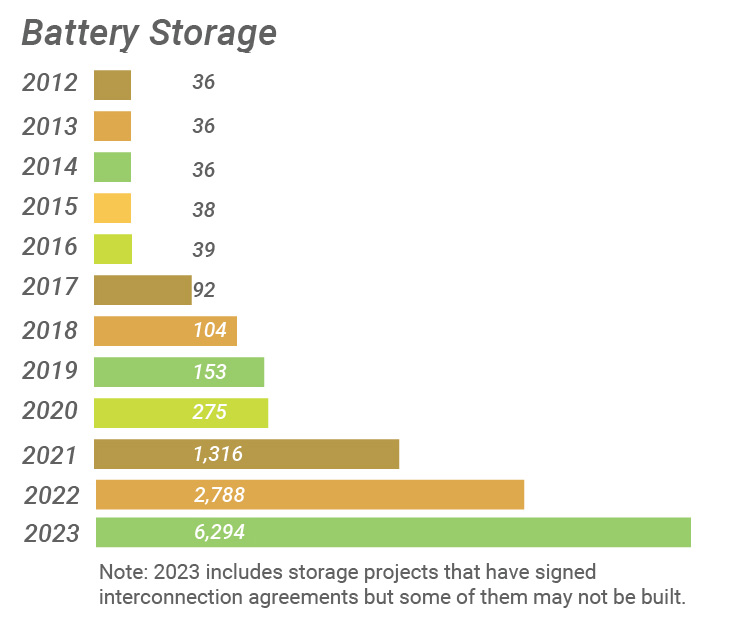

Energy Storage. Recent advancements in energy storage systems such as batteries have raised expectations that one day a combination of solar, wind, and energy storage could provide all the electricity for our grid. Batteries (like the ones used in your cell phone or computer, but bigger) can be used to store energy when demand is low -- and then released when the demand is high. Imagine if wind energy, produced at night in West Texas when demand is low, could be stored and used eight hours later when demand is high. Imagine if the energy from the midday sun could be captured and used in the evening when hard-working Texans return home at night. In the last few years, ERCOT and other areas of Texas have enjoyed significant growth in battery technology and projects. Some public power entities, including Currently, there are only a few large-scale electric storage projects in Texas, including at municipal utilities like CPS Energy, Pedernales Electric Cooperative, and Austin Energy, and electric cooperatives like Pedernales Electric Cooperative have used state and other incentives to invest in batteries near substations, while other but some developers have begun to invest in batteries to be located right next to solar and wind facilities, or in other locations along the grid. In 2020, a gigantic 100 MW electric battery facility opened near Fort Worth. In addition to batteries, other storage technologies include compressed air energy storage (CAES), flywheels, hydro-pump stations, and chilling stations, where ice is cooled at night then released during the day.

While energy storage still makes up a small tiny percentage of energy "generation" currently, ERCOT figures show that approximately 3,500 MWs of battery storage are already operating on the grid, and more will get added in the coming years. Thus, while only 275 MWs of battery was currently installed in ERCOT at the end of 2020, by June of 2023, there were 3,298 MWs of installed battery capacity and another 3,000 MWs of of new battery capacity was expected to come on-line within ERCOT by the end of 2023 . The recent increase in battery interconnection requests is partially due to declining battery technology costs and the availability of Investment Tax Credits for qualifying energy storage systems. Many of the battery projects under development are being co-located with solar facilities since batteries can be deployed when solar power is unavailable or at lower output levels to better match load ramps. Batteries also can effectively store wind power that is produced during off-peak hours. Finally, ERCOT has expanded the types of ancillary services which can be provided by batteries, meaning there is more opportunity for them to make money

Distributed Energy Resources. Any generation source that is connected at the "distribution" level as opposed to the transmission level and injects electricity into the grid is considered a distributed energy source. These can be "thermal" units, principally smaller natural gas or back-up diesel units, or rooftop solar units. ERCOT estimates that there are about 4,000 MWs of these "distributed energy resources" on the system. Any generator greater than 1 MW that is connected at the distribution level is required to register with ERCOT. Most of the registered units are thermal generators, community solar projects and a small number of storage devices. ERCOT estimates there are currently over 1,000 MWs of these “Settlement-Only” distributed generators registered with ERCOT, and another 400 MWs of distributed storage resources. Generators that are smaller than 1 MW, such as residential and commercial rooftop solar systems, are not required to register with ERCOT, although they do require transmission and distribution companies to report quarterly. The grid operator estimates these unregistered DERs totaled nearly 2,400 MWs in late 2023. ERCOT is requiring quarterly distribution utility reporting rules for these unregistered DERs since they can impact loads and pricing outcomes. About 90% of these unregistered DGs are solar, and about 80% of the unregistered DGs are smaller rooftop systems.

In 2022, the PUCT and ERCOT officially launched the Aggregated Distributed Energy Resource (ADER) Pilot Project to allow up to 80 MWs of these or similar resources like storage devices to be aggregated and offered into the ERCOT market, to provide energy or other services. Many experts believe that in the future much of our energy will be served by aggregating smaller resources and operating them as “Virtual Power Plants.”

While still being investigated, there is also a potential that in the near future as more and more electric vehicles are produced and sold in Texas, that the batteries of these vehicles can both charge electricity, but also at times discharge energy into the grid through “Vehicle-to-Grid” bidirectional charging. Again, at this point only a few small pilot projects have been successfully used but many experts believe it could be an important “Distributed Energy Resource” and form part of our grid. In the future, millions of cars and trucks in Texas will get their electricity from the grid, but also discharge into the grid as needed to supply electricity or help stabilize the grid.

Energy Efficiency. It takes a shift in perception to consider energy efficiency as an electricity resource, but the fact is that the cheapest, cleanest, and quickest energy resource is not needing so much electricity in the first place. More efficient light bulbs, air conditioners, dryers, water heaters, furnaces, dishwashers, water pumps, pool pumps, and other appliances can significantly lower electricity needs, while greener buildings (think more insulation, better building materials, and better windows) can significantly lower overall demand. Because of better buildings and appliances, the energy demand in Texas on a per-capita basis has actually been reduced. In Texas, because of a law and rules at the Public Utility Commission, the eight investor-owned utilities are required to run energy efficiency programs. Indeed, in 2022, about 600 MWs of peak demand and almost 700 GWhs of energy were reduced because of these programs. Sierra Club and many others have advocated for an expansion in the energy efficiency goals required by the Legislature and the Public Utility Commission, calling for an overall goal of one percent by 2030. Despite this advocacy effort, the Legislature and the Commission has not expanded these programs since 2011, although one piece of legislation that passed in 2023 does require the Commission to work with utilities and Retail Electric Providers on the creation of new residential demand response programs. A recent study found that Texas could cost-effectively lower energy summer peak demand by 14,800s of MWs in the summer and 23,500 in the winter through key investments in programs, saving customers an average of $13 dollars per month in the process.

See this report.

Passage of the Bipartisan Infrastructure Law and Inflation Reduction Act should make more energy efficiency programs accessible to Texans in the near future.

Demand Response. A cousin of energy efficiency, demand response, is essentially a pre-negotiated agreement between a home or business and a utility dealing with shifting when and how we use electricity involving both behavioral changes and technology. For example, "Smart" thermostats that maintain our comfort but lower the use of air conditioning at peak demand times, or controllable water heaters, or shifting when factories use electricity. These agreements can change the need for peak resources like natural gas plants. Financial incentives to actually pay electricity consumers to not use electricity when it is most expensive can play a large role in reducing our need for expensive power plants.

While the amount of Demand Response utilized in Texas is difficult to measure, ERCOT produces an annual report that attempts to measure how much DR is used in the ERCOT market. According to the 2022 Annual Report of Demand Response in the ERCOT Region, loads were contracted to provide approximately 900 MWs of "emergency response service" for emergencies in ERCOT -- and these resources were deployed during one three-hour period in 2022 -- and another 8,300 MWs of loads – virtually all industrial loads - were qualified to provide frequency response, an ancillary service in which loads are provided to be available to keep frequency levels within acceptable parameters. For 2022, the amounts of these loads that actually provided this service to ERCOT varied from 2300 MW during the early morning hours in July and August to 3178 MW for an off-peak hour during the fall and spring months. In 2022, ERCOT also began qualifying some other newer loads such as data centers for both frequency response and allowing some other industrial loads to provide “non-spin” ancillary services. Meanwhile, Investor-Owned Utilities provided another 400 MWs of peak demand response through rate-payer programs, most of it in the summer months. In addition programs provided by public municipal entities, and large businesses provided an estimated 2,000 MWs MWs of demand response to avoid high transmission costs, and a similar amount was used by public utilities, individual businesses and retail electric providers to avoid high peak prices. With the exception of a few programs offered by public utilities, transmission and distribution utilities or retail electric providers, the vast majority of these demand response programs are geared toward large industrial or large commercial electric consumers, even though peak winter and summer demand in Texas is largely driven by residential and small business customers. Getting more residential demand response in Texas will be a key way to make our grid cleaner, more reliable and cheaper for everyone.

Examples of residential demand response programs abound. As an example, while there are one million smart thermostats in the state, less than 10% of them are enrolled in demand response programs. Thus, owners of those thermostats are missing out on potential incentive savings that such programs could offer, even as the state is losing the benefit of this important resource. Pool pumps could throttle down in summer time when electricity demand peaks. So could refrigerators — again, with owners’ participation. Water heaters running on electricity with heat pumps are yet another example. Again, independent studies have suggested we could lower our peaks by thousands of megawatts by tapping into residential demand response.

Co-Generation. Texas is an industrial state. While many industrial facilities buy their electricity from power plants located throughout Texas, there are some industrial facilities that are part of "private use networks" that run their own power generation facilities which in general use natural gas as their power source. However, many industrial facilities have what are referred to as "co-generation" facilities. These facilities combine the use of gas power plants with "waste heat" from their production process to further heat the water that produces the steam that provides electricity. In this way, these facilities prevent excess heat (sometimes associated with air emissions) from escaping to the atmosphere and instead use it to help power industries. In addition to these larger co-generation facilities, there are a number of smaller "Combined Heat and Power" units on a smaller scale that can help provide electricity and heating of industrial and commercial facilities including some restaurants, hospitals and smaller industrial facilities.